Have you been wondering whether it’s time for you to start investing, or if you should focus on saving?

First, let’s discuss the difference between saving versus investing. They are used interchangeably but serve vastly different purposes. The act of taking a sum of money and consciously set it aside for future purposes or as an emergency fund is called saving, whereas the act of putting funds in the money market, or investment instruments in order to aid capital growth on the basis of compounding interest rates, direct stock equity profits, mutual funds, or bonds or real estate is called investment.

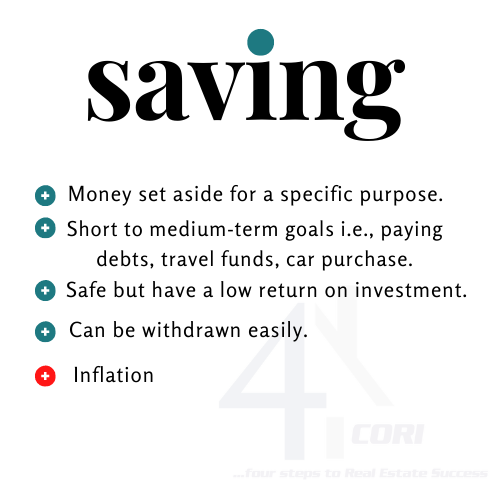

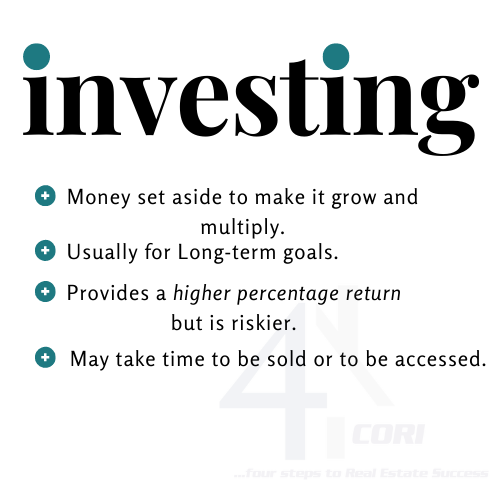

Below is a quick and direct comparison between saving versus investing.

A very important factor in saving your money in the bank is inflation, a subject often ignored. An article from Investopedia explained it as below.

Let’s say you have $100 in a savings account that pays a 1% interest rate. After a year, you will have $101 in your account. But if the rate of inflation is running at 2%, you would need $102 to have the same buying power that you started with.

You’ve gained a dollar but lost buying power. Any time your savings don’t grow at the same rate as inflation, you will effectively lose money.

Furthermore, here’s a quick rundown on Banks’ untold story on why they are very rich.

-We deposit and we are usually given a 1% PA return. Then if we (clients) need more money we will usually LOAN to the bank.

- Bank will grant the personal loan with a 6-8% interest per year.

- A business loan is 12-15% interest per annum.

- Credit card – 3.5 % per month or 42 % per year.

So, the reality is, if we just put the money in the bank as savings, we will be given 1% interest but you can be charged with 6 to 42% for loans. Moreover, that 1% interest may then just be lost due to inflation.

Thus, banks are earning from the money that we loan from them but in the first place, these are also the money that we own and put in as savings.

So, why should we allow are banks to use our money? Why can’t we use our own money to grow our money?

To answer the aforementioned queries, we have to ask ourselves the following. What are my goals? Do I have a plan to reach these goals? Do I have enough knowledge to engage?

Central Ohio Real Estate Investment LLC meets with every investor. We find out goals, create an investment plan, and ensure follow-up, to make sure the investor’s goals are met.

Real Estate Opportunity in Central Ohio (and nearby cities) is a great way to make money, but it is not a sit back and get rich investment. But when it is done right can be very lucrative for the real estate investor.